arizona charitable tax credit fund

Maximum contributions are 400 for filing single or 800 for filing jointly. Here is a great example from the Arizona Department of Revenues website.

Tax Credit Charitable Giving For Free Fsl

You can choose any of the tax credit eligible organizations and donate between now and either December 31 2021 or April 15 2022 depending on the organization.

. Claim the charitable deduction on their Federal Tax Return. 20th St Phoenix AZ. The Arizona Tax Credit program is beneficial for state taxpayers because it allows some control over where tax dollars are going.

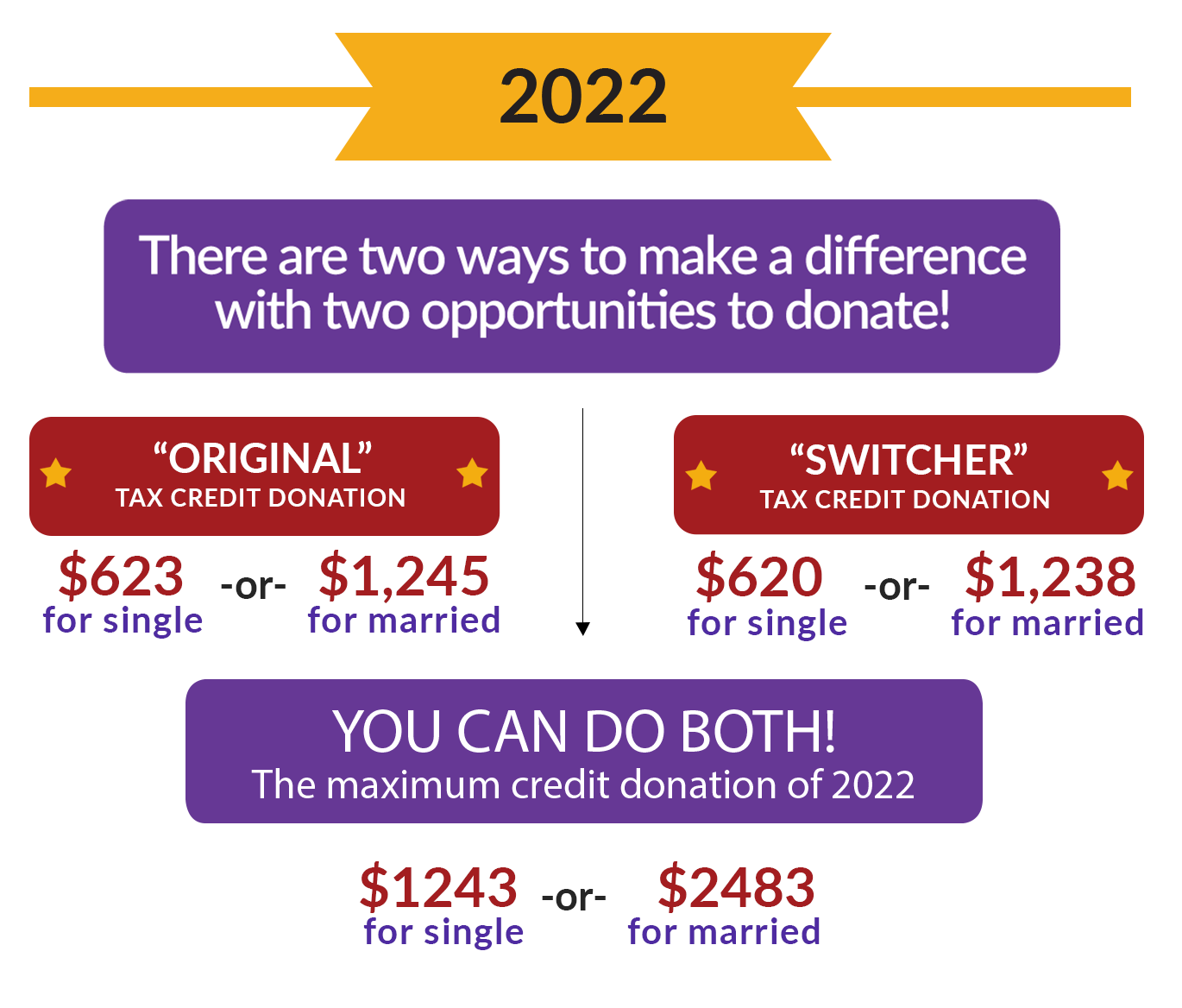

But since you donated 400 to Flagstaff Shelter Services and 500 to a foster care organization you can subtract that from the 1200 tax bill so. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit.

Once 1 million in donations is reached contributions must be returned therefore its best to send your donation in early so you are ensured a credit on your Arizona tax return. Please consider taking advantage of this credit by making a donation to. Review the AZ Tax Credit.

Donate up to 400 single filer and up to 800 married filing jointly and Arizona will deduct 1 for 1 what you owe. Now you can donate up to 400 for individuals single taxpayer and 800. Have the unique opportunity to actually redirect a portion of the state tax dollars they owe or already paid to an organization that provides help to the working poor - all at no financial cost to themselves.

Making donations to the eligible organizations means. The Credit for Donations made to Qualifying Charitable Organizations QCO provides vital support to Arizonas most vulnerable children and families. A credit is possible only if you have a Arizona income tax obligation and if the credit claimed is less than your Arizona tax obligation.

2021 Arizona Tax Credits and Limits Tucson Arizona Certified Public Accountants and Consulting Serving Tucson for over 30 Years. The Power of Endowment. The YMCA Tax Credit Fund LLC qualifies as a QCO.

If you earned 40000 and donated 400 to FSL and 500 to a foster care organization a tax deduction policy means your income is considered to be 39100. Take a Tax Credit on their AZ state return up to 400 dollars each year andor 800 per couple. The charity must be qualified and designated by the Arizona Department of Revenue.

Arizona Charitable Tax Credit Fund Paradise Valley Community College Qualified Charitable Organizations Az Tax Credit Funds 2021 Arizona Tax Credits Hbl Cpas Share this post. IMPACT of Southern Arizona a Qualified Tax Credit Organization is a member of the AZ Charitable Tax Credit Coalition. 20113 Arizona Coalition for Tomorrow Charitable Fund Inc.

Thanks to the Arizona Charitable Tax Credit program you have an incentive to support Care Fund. Your donation then can be taken as a credit on your Arizona income tax obligation IN ADDITION TO foster care school or other similar tax credits. Giving through the Arizona Charitable Tax Credit is an easy way to redirect the money you would otherwise be paying in taxes.

The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing separately and heads of household filers. 21001 N Tatum Blvd 1630-403 Phoenix AZ 85050 22216 Arizona Community Action Association DBA Wildfire 340 E Palm Ln Ste 315 Phoenix AZ 85004 20450 Arizona Daily Star Sportsmens Fund PO Box 16141 Tucson AZ 85732 20700 Arizona Dental Foundation 3193 N Drinkwater Blvd Scottsdale. This charity fund has a 1 million cap for refundable Arizona tax credits so its best to get your contribution in early during the year.

This tax credit is available for cash contributions and is claimed on Arizona Form 322. 608 for single heads of household and married filing separate filers. You can give hope to families and individuals by making a contribution.

Arizona Philanthropy Made Easy. The Arizona Military Relief Fund provides financial assistance to families of currently deployed service members post 911 military. Iklan Tengah Artikel 1.

Or if you prefer please fill out this Donor Information Form QFCO number. Know 100 of their donations fund IMPACT programs. Unused credit can be carried forward 5 years.

Uses Tax Credit Form 321. To ensure that the charity is still listed for 2022 tax credit purposes. Iklan Tengah Artikel 2.

Information on the Arizona Charitable Tax Credit. If you earned 40000 a tax credit policy means that with a 3 tax rate you would owe 1200 in taxes. Our Qualifying Charity Organization QCO number is 20941 Tax ID.

Contributions for the 2021 tax year can be made through April 18th 2022. This tax code allows for donations to qualifying organizations be returned to the taxpayer not as a deduction but as a. For Tucson and all 520 and 928 area codes call 800-352-4090.

One Arizona Form 321 and Arizona Form 352 the two forms used for the Arizona Charitable Donation Tax Credit two numbers are included for contact with questions about the credits. Mary can apply 250 of the credit to her 2019 tax liability and carryover 150 of the unused 400 credit to. 1214 for married taxpayers filing a joint return.

If the credit claimed is more than your current year Arizona tax obligation the unused credit may be carried forward. Marys 2019 tax is 250. Maximum credit for the 2021 tax return.

Donations by the tax filing deadline typically April 15 qualify for a tax credit for the previous tax year. Newer Post Older Post Home. A tax credit is a better deal and this is how Arizonas charitable tax credit policy works.

Effective in 2018 the Arizona Department of Revenue has assigned a five 5 digit code number to identify each Qualifying Charitable Organization and Qualifying Foster Care Charitable Organization for Arizona tax credit purposes on Form 321 and Form 352 which is included with the Arizona income tax return. For 2019 Mary is allowed a maximum credit of 400. In Arizona instead of reducing the amount of taxable income the state charitable tax credit policy reduces your overall taxes.

The Arizona Charitable Tax Credit is a dollar-for-dollar tax credit allowing you to donate to qualified Arizona organizations and claim a dollar-for-dollar state tax credit of up to 800 if married filing jointly or 400 if filing individually. Claim the credit on your Arizona state tax form. With a 3 tax rate you would owe 1173 in taxes.

Credit can only be taken if the individual taxpayers. For Phoenix and all 602 area codes call 602-255-3381. Step 3 - Receive.

Credit can offset Arizona tax liability dollar for dollar but is not refundable. Your donation to the QCO tax credit will support organizations assisting low-income children individuals and families. DONATIONS FOR TAX YEAR 2021 MAY BE MADE THROUGH APRIL 15 2022.

Valley of the Sun United Way relies on charitable donations to continue to fund critical programs in our community all of which focus on tackling todays most pressing issues including health and hunger housing. The Arizona Charitable Tax Credit allows individuals to donate to a qualified Arizona nonprofit organization and claim a dollar-for-dollar state tax credit of up to 400. 10026 and mail it with your check to.

During 2019 Mary a single person gave 600 to a qualified charity. This change is in effect until June 30 2022.

Cdt Kids Charity Arizona Tax Credit

Donate To Arizona Tax Credit To Help Children Receive

Qualified Charitable Organizations Az Tax Credit Funds

Proposed Amendment To Tax Regulations Make Your Donations By 8 28 Fsl Org

Start The Process Az Tax Credit Funds

Arizona Charitable Tax Credit Can Benefit Hcc

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Arizona Charitable Tax Credit Fund Paradise Valley Community College

List Of 6 Arizona Tax Credits Christian Family Care

Arizona Tax Credits Mesa United Way

Know Each Tax Credit S Limit 2021 Fsl Org

2021 Arizona Tax Credits Hbl Cpas

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

List Of 6 Arizona Tax Credits Christian Family Care

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Charity Donation Tax Credit Guide Give Local Keep Local